Results: 39 Matching Jobs & Internships

Policy Officer - Policy Department

Solidarity Center seeks a Policy Officer for a newly created position in an expanding Executive Office to assist in raising the profile of the issues facing workers in today’s global economy as well as the work of Solidarity Center and its allies.

Employment Type

- Full-time

Application Deadline

- 04/25/2024

Executive/Senior Executive (Executive Education)

National University of Singapore invites applicants to fill the position of Executive/Senior Executive (Executive Education) to support the development and delivery of high quality executive education programmes.

Employment Type

- Full-time

Application Deadline

- 04/26/2024

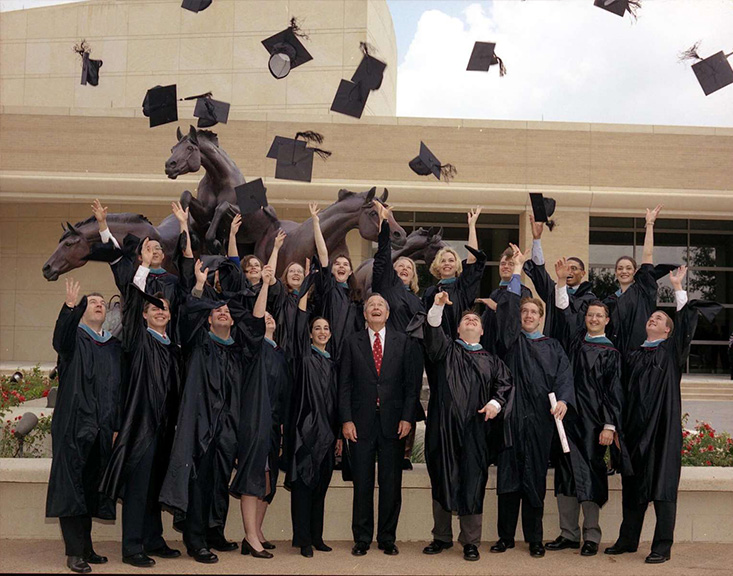

Executive Director, Center for Public Leadership

Harvard's CPL seeks a Executive Director to mobilize a highly motivated and talented staff to deliver on the Center’s vision and promote a workplace grounded in respect and excellence.

Employment Type

- Full-time

Application Deadline

- 04/30/2024

Assistant Director, Communications

The Assistant Director, Communications will lead the Wagne School's efforts around the following: full-scale content creation

Employment Type

- Full-time

Application Deadline

- 04/30/2024

Executive Director of Executive Development Programs

Johns Hopkins is seeking an Executive Director of Executive Development Programs who will be responsible for the overall management and direction of various executive development programs.

Employment Type

- Full-time

Application Deadline

- 04/30/2024

Adjunct Faculty Positions (Undergraduate or Masters Courses)

American Univ. SIS is seeking to fill multiple faculty teaching positions in international relations at the undergraduate and/ or graduate levels.

Employment Type

- Faculty / Scholar

Application Deadline

- 04/30/2024

Senior Program Officer, Transnational Kleptocracy

The International Forum for Democratic Studies at the National Endowment for Democracy is a leading center for research, discussion, thought, and analysis on the theory and practice of democracy around the world. The Senior Program Officer will help the Forum take NED’s work on Combating Transnational Kleptocracy to a new level. The ideal candidate will bring a strong background on issues relating to the evolving challenge of transnational kleptocracy and its impact on democracy, including the flow of illicit money and other forms of grand corruption, foreign influence of oligarchic and other kleptocratic networks, and, critically, civil society responses to these challenges. The ideal candidate will have relevant research and analytic experience working with leading experts in the think tank, civil society, and advocacy communities.

Employment Type

- Full-time

Application Deadline

- 04/30/2024

Program Officer, Transnational Kelptocracy

The International Forum for Democratic Studies at the National Endowment for Democracy is a leading center for research, discussion, thought, and analysis on the theory and practice of democracy around the world. The Senior Program Officer will help the Forum take NED’s work on Combating Transnational Kleptocracy to a new level. The ideal candidate will bring a strong background on issues relating to the evolving challenge of transnational kleptocracy and its impact on democracy, including the flow of illicit money and other forms of grand corruption, foreign influence of oligarchic and other kleptocratic networks, and, critically, civil society responses to these challenges. The ideal candidate will have relevant research and analytic experience working with leading experts in the think tank, civil society, and advocacy communities.

Employment Type

- Full-time

Application Deadline

- 04/30/2024

Assistant Director of Student Services

The Assistant Director of Student Services is responsible for a wide range of duties associated with leading a diverse service orientated team and serving over 600 undergrad and grad students. Reporting to the Director of Academic Services and working in close collaboration with other team members; the central responsibility of this position is increasing student enrollment though thoughtful recruitment, support of career services, oversight of scholarship and the JSIS course schedule production. This role is responsible for providing the operational and administrative framework and establishing student services best practices for a dedicated team of operational experts. The Assistant Director will be the main point of contact and liaison to centralized services such as career services, alumni relations, and the Time Schedule Office. They will also create and leverage a strong relationship with the Association of Professional Schools of International Affairs (APSIA) to best position our JSIS students for career and internship opportunities. They will identify unique needs of JSIS students in addition to what is provided centrally and develop programs and services to support these needs. The Assistant Director makes operational and strategic recommendations to the Director to address emerging and critical student service needs and opportunities. This role will actively participate in strategic planning efforts to update and streamline the JSIS student services, to reflect the interests of our current and future students.

Employment Type

- Full-time

Application Deadline

- 04/30/2024

Press Secretary

The National Endowment for Democracy seeks an experienced, connected, and collaborative Press Secretary to build our network and strengthen the impact of our work and mission.

Employment Type

- Full-time

Application Deadline

- 04/30/2024

Digital Strategist

The Digital Strategist is responsible for developing the strategy, execution, and management of NED’s website and affiliated sites to rethink NED’s presence across digital platforms.

Employment Type

- Full-time

Application Deadline

- 04/30/2024

Tenure-Track Assistant Professor

The Sanford School of Public Policy invites applicants across a range of policy areas, with domestic or global research focus.

Employment Type

- Faculty / Scholar

Application Deadline

- 04/30/2024